Securities custody is the receipt of consignment, safekeeping, transfer and acknowledgement of securities ownership of customers in the securities custody account system managed by Vietnam Securities Depository and Clearing Corporation (VDSC) in order to guarantee rights and interests relating to securities of owners.

Customers can have their shares deposited in one of the following three ways

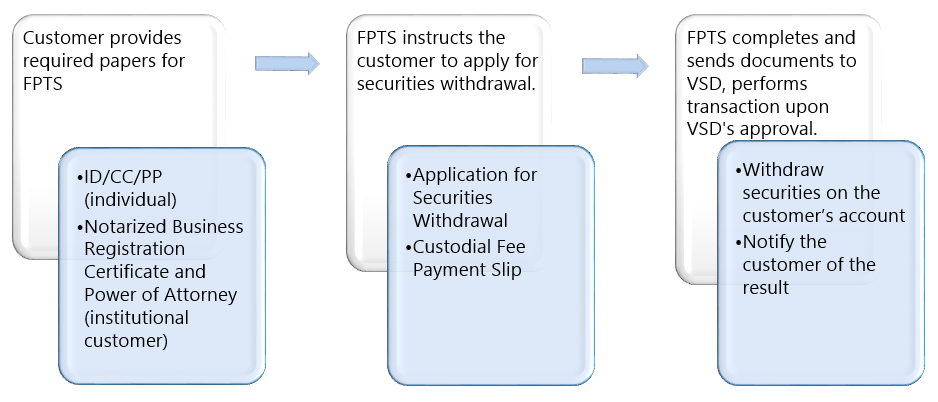

Customers contact the Custody and Shareholding Management Counter at FPTS Head Office, Branches and Transaction Offices when they wish to withdraw securities they have deposited.

Documents include:

- Identity Card/Citizenship Card/Passport (valid original): Applicable to individual customer

- Business Registration Certificate (notarized copy): Applicable to institutional customer

- Power of Attorney

- Application for Securities Withdrawal

Steps:

If you want to transfer securities in your depository account opened at FPTS to the account opened at other depository member, please contact the Account Counter at the FPTS Head Office and Branches/Transaction Offices to have advice and procedural guidance.

Please show the following papers at the Account Counter to have transfer procedures completed:

- Individual customer

- Valid original Identification Card/Citizenship Card (Vietnamese customer) or valid Passport (foreign customer)

- Institutional customer

- Business registration certificate: 01 public notarized copy

- Acknowledgement letter

Time for completion: 03 working days from the date of receipt of sufficient valid papers.

Note: Your personal information at the transferring depository member and that at the receiving depository member must be identical and the receiving account must be already activated at Vietnam Securities Depository and Clearing Corporation (VDSC).

In case customers mortgage their assets in securities transaction accounts to secure their loans at credit institutions, upon the request of such credit institutions, FPTS will confirm securities blocking at FPTS and, at the same time, conduct procedures to block the securities at Vietnam Securities Depository and Clearing Corporation (VDSC). After FPTS confirms the blocking, the mortgaged securities will not be allowed to be traded until there is an official release/unblocking document from such credit institutions and approval of the VSD.

* Note:

The verification of securities mortgaged shall be performed at only Vietnam Securities Depository and Clearing Corporation (VDSC) in case the mortgage-receiving party is credit institution certified.

Customers necessarily contact the FPTS Custody and Shareholding Management Department to have their mortgaged securities blocked/unblocked.

Securities mortgage documents include

- Identity Card/Citizenship Card/Passport (valid original copy), applicable to individual customer, or Business Registration Certificate (public notarized copy) and Identity Card/Citizenship Card/Passport of the legal representative, applicable to institutional customer

- Securities Mortgage Contract: 01 copy

- Power of Attorney (if any)

- Application for Securities Mortgage: 03 copies (Form No. 02/BD)

- Application for registration of Securities Mortgage: 04 copies (Form No. 52 – ND155/2020/ND-CP)

- List of Securities Mortgaged verified by the mortgage-receiving party: 04 copies (Form No. 53 - ND155/2020/ND-CP)

- Request to FPTS to block securities as loan security validated by the customer and the credit institution (lending party): 03 copies

FPTS will perform securities blocking procedures and notify the customer of the result in three (03) working days from the date of receipt of full valid documents and the receipt of fee and tax for the mortgaged securities (according to the Tariff of VSD and FPTS) of the customer. Please click here to see the current Service Tariff of FPTS.

Mortgaged Securities release documents include:

- Identity Card/Citizenship Card/Passport (valid original copy), applicable to individual customer, or Business Registration Certificate (public notarized copy) and Identity Card/Citizenship Card/Passport of the legal representative, applicable to institutional customer

- Application for deregistration of Securities Mortgaged: 04 copies (Form No. 56 – ND155/2020/ND-CP)

- List of Securities Mortgaged verified by the mortgage-receiving party: 04 copies (Form No. 57 – ND155/2020/ND-CP)

- Request to FPTS to release mortgaged securities validated by the customer and the credit institution (lending party): 03 copies

FPTS will perform securities unblocking procedures and notify the customer of the result in three working days from the date of receipt of valid documents

Customers contact the FPTS Custody and Shareholding Management Counter when they wish to have their securities blocked/unblocked at FPTS, applied to listed securities.

- Securities blocking documents at Investor’s Request include:

- Identity Card/Citizenship Card/Passport (valid original copy), applicable to individual customer, or Business Registration Certificate (public notarized copy) and Identity Card/Citizenship Card/Passport of the legal representative, applicable to institutional customer

- Request for securities blocking of investor: 03 copies (Form No. 29/LK)

- Other documents relating to the blockade (if any)

FPTS will perform securities blocking procedures and notify the customer of the result in three (03) working days from the date of receipt of full valid documents and the receipt of fee and tax for the mortgaged securities (according to the Tariff of VSDC and FPTS) of the customer. Please click here to see the current Service Tariff of FPTS.

- Securities unblocking documents at Investor’s Request include:

- Identity Card/Citizenship Card/Passport (valid original copy), applicable to individual customer, or Business Registration Certificate (public notarized copy) and Identity Card/Citizenship Card/Passport of the legal representative, applicable to institutional customer

- Request for Securities Release: 03 copies (Form No. 31/LK)

- Other documents relating to the release (if any)

FPTS will perform securities unblocking procedures and notify the customer of the result in three working days from the date of receipt of valid documents.

Customers contact the Custody and Shareholding Management Counter at FPTS Head Office, Branches and Transaction Offices when they wish to present their securities they have deposited.

Documents include:

1. Request for the transfer of ownership rights of given securities

2. Valid identity papers of the Giving Party:

- Individual:

- Identity Card/Citizenship Card/Passport (valid original)

- In case the Given Party is juvenile, he/she shall have the verification document from the guardian or legal representative.

- Institution:

- Business Registration Certificate: Notarized copy

- Identity Card/Citizenship Card/Passport (valid original) of legal representative of the institution

3. Contract for Securities Giving, verified by Public Notary or relevant authorities: 01 original or notarized copy

4. Proof of income tax payment (Declaration/Notice of income tax payment, verified by tax authorities).

5. Proof of information disclosure in line with the Securities Law, applied to certain cases.

FPTS will perform securities giving procedures and notify the customer of the result in seven working days from the date of receipt of valid documents

Inheriting securities

Inheritors or guardians go to the FPTS Head Office, Branches and Transaction Offices to conduct inheritance procedures for deposited securities.

1. Confirm Securities Balance and Escrow Securities

If customers want to sell securities in a public bid, they must firstly take the Application for Securities Sale Registration at the Bid Agent. Then, they need to contact the FPTS Custody and Shareholding Management Counter for detailed instructions for determining securities balance and escrowing securities.

- Documents include

- Identity Card/Citizenship Card/Passport (valid original): Applicable to individual customer

- Business Registration Certificate (notarized copy) and Letter of Recommendation: Applicable to institutional customer

- Securities Sale Registration Form (provided by Bid Agent).

2. Releasing escrowed securities after cancelling sale registration

To cancel sale registration, customers must contact the Bid Agent to get the Sale Registration Cancellation Form with an official seal stamped by the Bid Agent. Based on customer’ request and the Sale Registration Cancellation Form, FPTS will perform unblock securities held in an escrow.

- Documents include

- Identity Card/Citizenship Card/Passport (valid original): Applicable to individual customer

- Business Registration Certificate (notarized copy) and Letter of Recommendation: Applicable to institutional customer

- Sale Registration Cancellation Form (verified by the Bid Agent).

3. Payment settlement for securities sold, payment of fees and taxes

The time for settling payment for securities sold and transferring securities ownership rights is ten days dating from the date of closing the bid offer. Proceeds will be transferred into the account of customers opened at FPTS.

FPTS shall withhold money from the customer’s account to pay for transaction fees and income tax according to the law before settling the final payment for customers. For fee payment, please refer to the FPTS Service Tariff for Underlying Securities.

- Tradeable Securities Custody Form

- Tradeable Securities Deposit Form, Applied to Customers with Changed Information

- Application for Securities Withdrawal

- Application for Transfer of Securities Ownership Rights

- Securities Ownership Transfer Contract provided by FPTS

- Request for Holding Securities in Escrow for Loan Security

- List of Securities Requested for Being Held in Escrow

- List of Securities Requested for Release from Escrow

- Request for Voluntary Securities Blocking

- Request for securities release

- Request for the transfer of ownership rights of given securities

- Request for the transfer of ownership rights of inheritor or the representative of beneficiaries

Custody and Shareholding Management Department

FPT Securities Joint Stock Company (FPTS)

--------------------------------------

Head Office in Hanoi:

No. 52 Lac Long Quan Road, Buoi Ward, Tay Ho District, Hanoi City, Vietnam

Tel: 19006446, ext. 4

Fax: +84 24 3773 9058

Han Thuyen Transaction Office:

Floor 2, No. 21 Han Thuyen, Hai Ba Trung District, Hanoi City, Vietnam

Tel: 19006446, ext. 4

Fax: +84 24 3933 6168

Ho Chi Minh City Branch:

Floor 3, 136-138 Le Thi Hong Gam, Nguyen Thai Binh Ward, District 1, Ho Chi Minh City, Vietnam

Tel: 19006446, ext. 8711

Fax: +84 28 6291 0559

Phan Dang Luu Transaction Office:

No. 159C, Phan Dang Luu, Ward 1, Phu Nhuan District, Ho Chi Minh City, Vietnam

Tel: 19006446, ext. 4

Fax: +84 28 3995 6997

Da Nang Branch:

Floor 3 and 4, Trang Tien Office, No. 130 Dong Da, Thuan Phuoc Ward, Hai Chau District, Danang City

Tel: 19006446, ext: 666

Fax: +84 236 3553 888

.png)